Document Handling & Processing

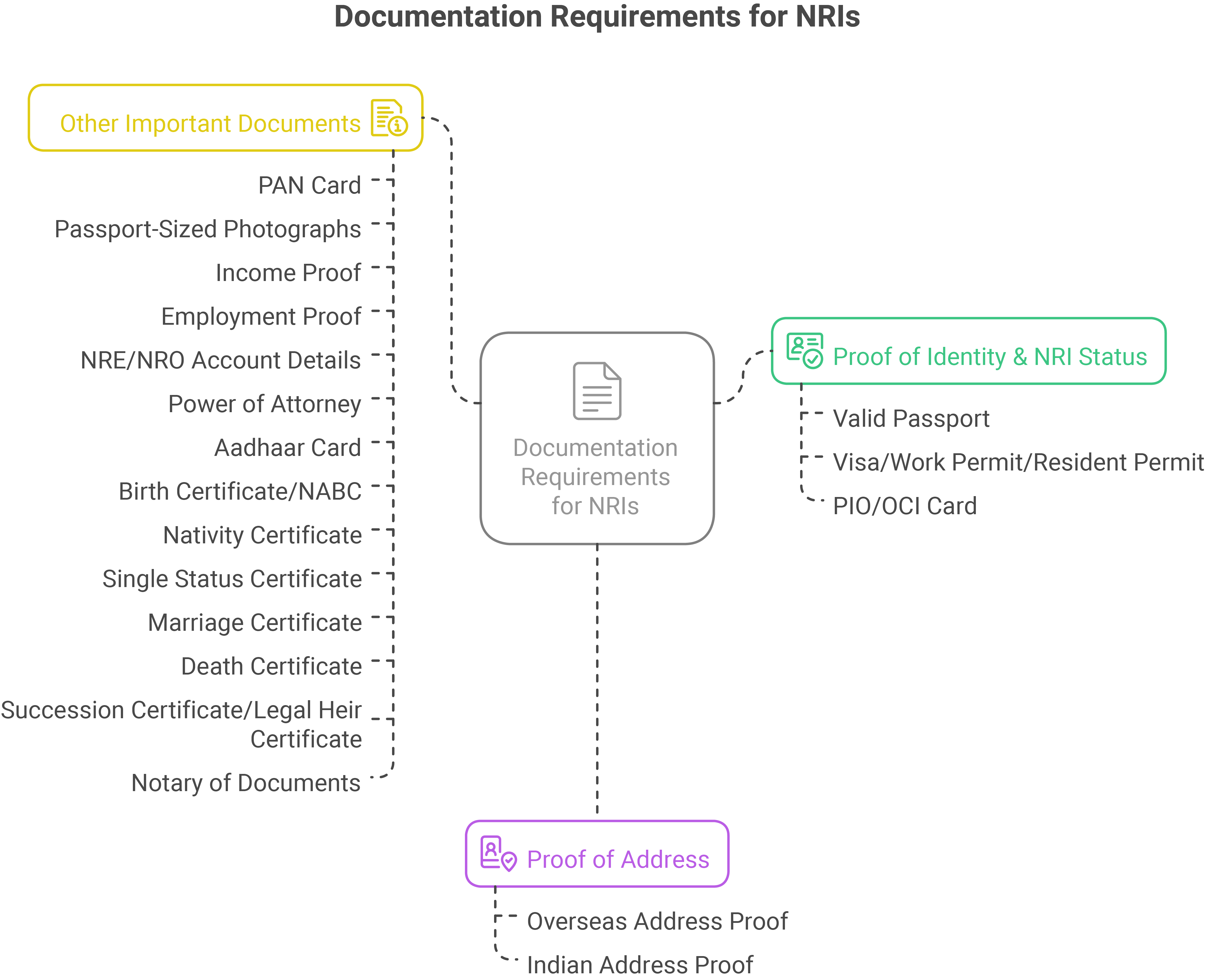

As an NRI, you often juggle multiple responsibilities—managing property, handling finances, or ensuring your family’s well-being back home. Having access to the right documents can make these tasks smoother.

Here’s a guide to the most crucial Indian official documents you might need and how to obtain them from abroad.

Permanent Account Number (PAN) Card

A PAN card is essential for financial transactions and tax purposes in India.

Why You Need It:

- Filing income tax returns

- Property transactions

- Opening bank accounts

How to Apply:

- Visit the NSDL PAN Portal. (we have observed that the link may not be available intermittently – please keep trying)

- Choose the NRI application form (Form 49AA).

- Upload necessary documents: passport, proof of foreign address, and photographs.

- Pay the application fee online.

Processing Time: 2–4 weeks

Delivery: Sent to your foreign or Indian address

Aadhaar Card

While Aadhaar is primarily for residents, if you had enrolled while in India, you might need it for various services.

How to Access:

- Visit the UIDAI Portal.

- Use your Aadhaar number or Virtual ID to download e-Aadhaar.

- For updates, you may need to visit India in person.

Power of Attorney (PoA)

A PoA allows someone in India to act on your behalf for various matters.

Why You Need It:

- Property transactions

- Legal matters

- Financial dealings

How to Execute from Abroad:

- Draft the PoA: Clearly define the powers granted.

- Notarisation: Get the document notarised by a Notary Public in your country.

- Attestation: Have the notarised PoA attested by the Indian Embassy or Consulate. In some countries, an Apostille may be sufficient.

- Send to India: Courier the attested PoA to your representative in India.

- Registration in India: The representative must get the PoA registered at the local Sub-Registrar’s office within three months of receipt.

Important Notes:

- Ensure the PoA is specific and detailed to avoid legal complications.

- For property transactions, registration in India is mandatory.

- Consult a legal professional to ensure the PoA meets all legal requirements.

Legal Documents (Birth, Marriage, Death Certificates)

These documents are essential for various legal and personal matters.

How to Obtain:

- Contact the local municipal authority where the event occurred.

- Some states offer online services for certificate issuance.

- In case of difficulty, consider hiring a local agent or legal professional in India.

Income Tax Documents / Filing as an NRI

NRIs may still need to:

- File tax returns if they earn income in India

- Claim TDS refunds

- Report capital gains

Tools Available:

- Income Tax e-Filing Portal

- Appoint a Chartered Accountant in India

- Track TDS on TRACES Portal (we have observed that the link may not be available intermittently – please keep trying)

Tips for Managing Documents from Abroad

- Digital Copies: Always keep digital copies of important documents.

- Legal Assistance: Consider hiring legal professionals in India to handle document-related tasks.

- Regular Updates: Keep your documents updated to avoid complications.