NRE Accounts

For Non-Resident Indians (NRIs), an NRE (Non-Resident External) account is an essential banking facility that allows them to manage their India-based finances while living abroad. This guide provides comprehensive details on NRE accounts, their features, benefits, eligibility, documentation, and a comparison with other NRI banking options.

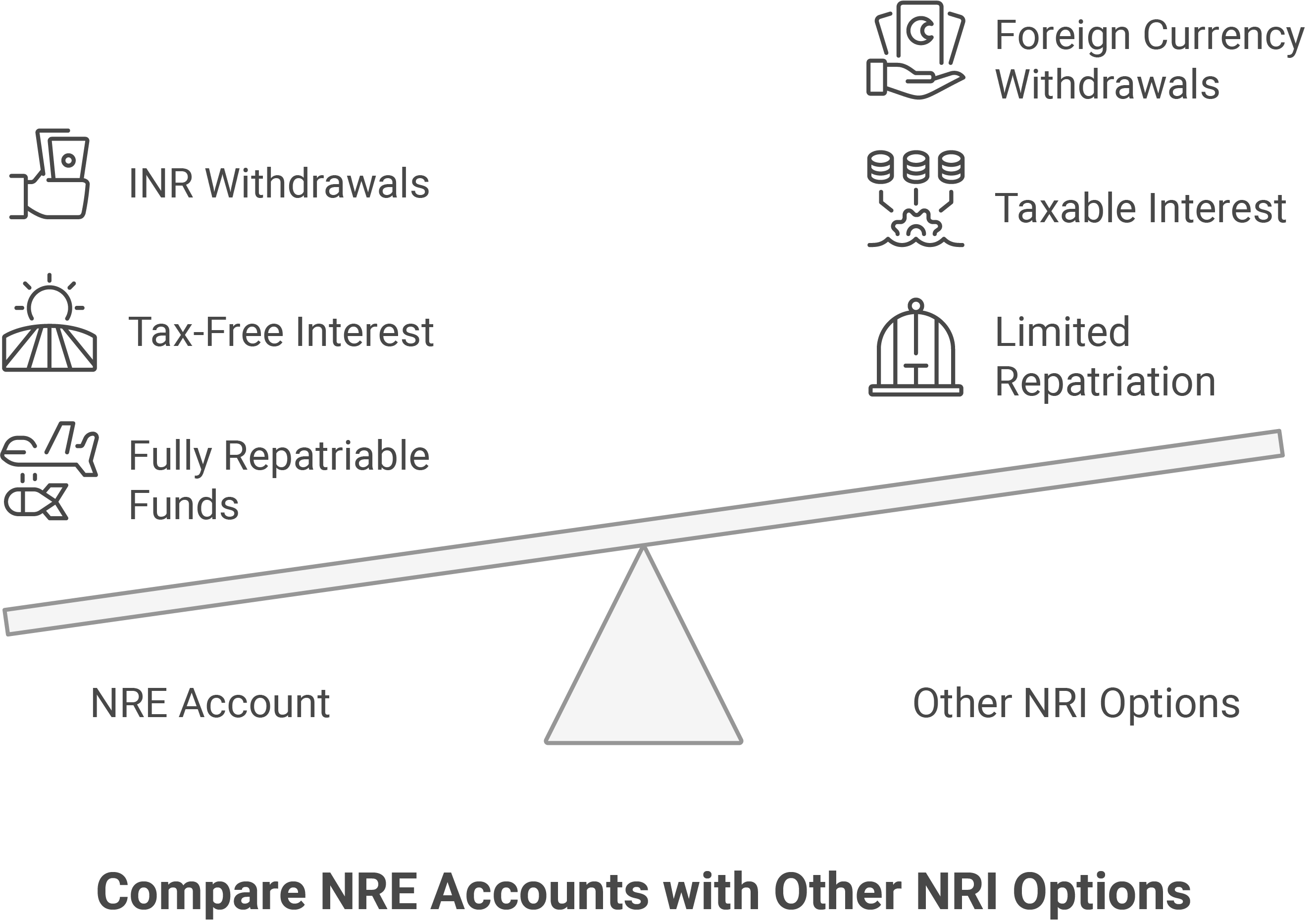

An NRE (Non-Resident External) account is a rupee-denominated bank account designed for NRIs to deposit foreign income in India. The primary advantage of an NRE account is that it allows repatriation of funds (money can be transferred freely between India and abroad) and offers tax-free interest earnings in India.

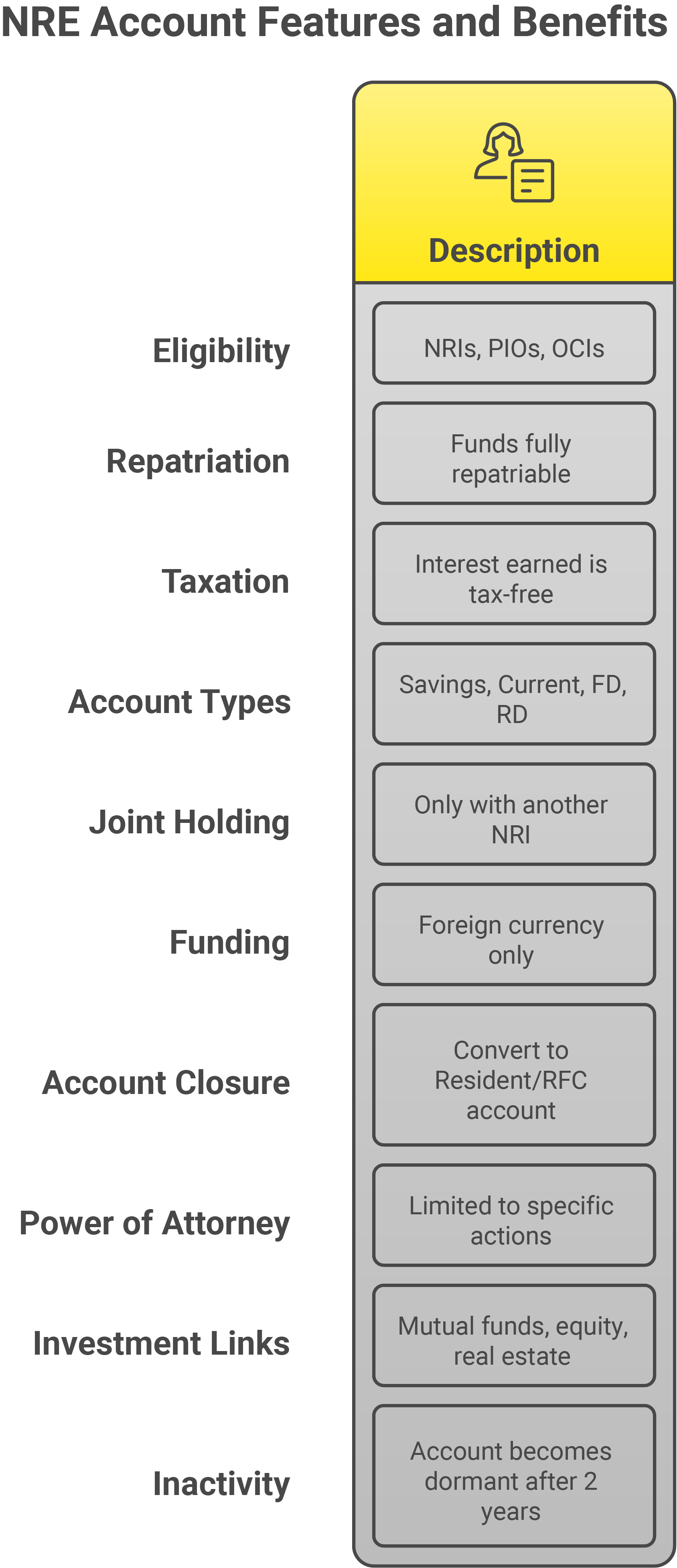

Key Features:

- Funds are fully repatriable (can be transferred abroad).

- Interest earned is tax-free in India.

- Can be maintained as a Savings, Current, Fixed Deposit (FD), or Recurring Deposit account.

- Deposits can be made in foreign currency, but withdrawals are in Indian Rupees (INR).

- Can be jointly held only with another NRI (not with a resident Indian).

Benefits of an NRE Account

| Feature | Benefit |

| Repatriation | Funds (principal + interest) can be freely transferred abroad without restrictions. |

| Tax-Free Interest | No income tax, wealth tax, or gift tax on interest earned. |

| Easy Foreign Transfers | Deposit in foreign currency, converted to INR at competitive exchange rates. |

| Joint Account | Can be held with another NRI. |

| Online Banking | Most banks provide 24×7 net banking and international debit cards. |

| Currency Fluctuation Advantage | Ideal if you wish to convert foreign currency to INR when exchange rates are favorable. |

Who Can Open an NRE Account?

An NRE account can be opened by:

- NRIs (Non-Resident Indians).

- PIOs (Persons of Indian Origin).

- OCIs (Overseas Citizens of India).

Who Cannot Open an NRE Account?

- Indian residents.

- Foreign citizens (unless they hold OCI/PIO status).

Types of NRE Accounts

| Type | Purpose |

| NRE Savings Account | For day-to-day transactions, withdrawals in INR. |

| NRE Fixed Deposit (FD) | For higher interest earnings, fully repatriable. |

| NRE Recurring Deposit (RD) | Ideal for saving money in small monthly deposits. |

| NRE Current Account | Suitable for NRIs doing business in India. |

Tip: If you want to invest in India or hold foreign income in INR without restrictions, an NRE Fixed Deposit is a great option due to its tax-free interest and liquidity.

How to Open an NRE Account?

The process to open an NRE account is straightforward and can be done online or in person at the bank’s branch.

Step 1: Choose a Bank

Most major Indian banks offer NRE accounts, including:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- Bank of Baroda

Step 2: Gather Required Documents

To open an NRE account, you need:

- Passport copy (with valid visa page).

- Overseas address proof (utility bill, bank statement, or rental agreement).

- Indian address proof (if applicable).

- PAN Card (if available, but not mandatory for NRE savings accounts).

- Initial deposit (varies by bank, typically ₹10,000 to ₹50,000).

Step 3: Submit Application

- Online Mode: Fill out the bank’s NRE account application form online and upload scanned documents.

- Offline Mode: Visit a bank branch in India or a designated branch abroad.

Step 4: KYC & Verification

- The bank may conduct a video KYC verification.

- Some banks may ask for documents to be notarized or attested by the Indian Embassy.

Step 5: Fund the Account

- You can remit money from abroad via wire transfer, SWIFT, or foreign remittance services.

- You cannot deposit Indian rupees into an NRE account.

How to Transfer Money to an NRE Account?

You can fund an NRE account only via:

- Wire transfer from a foreign bank account.

- SWIFT transfer via an international bank.

- Foreign currency cheque deposited into the NRE account.

Tip: Use bank remittance services (like Wise, Western Union, or bank-specific remittance portals) for better exchange rates.

Taxation on NRE Accounts

NRE Account Tax Benefits in India:

- No tax on interest earned.

- No wealth tax or gift tax.

- No TDS (Tax Deducted at Source) on interest income

Taxation Abroad:

- Some countries (like the USA, UK, Canada) may tax your NRE interest earnings, so check local tax laws.

Tip: Consult a tax advisor for double taxation treaties (DTAA) between India and your country of residence.

How to close an NRE Account?

If you become a resident Indian again, you must convert your NRE account to a Resident Account or an RFC (Resident Foreign Currency) Account.

Steps to Close an NRE Account:

- Submit a closure request to the bank

- Withdraw or transfer funds to another NRI or Resident Account.

- Provide necessary documents (passport, address proof).

Power of Attorney (PoA) for NRE Accounts

If you want a trusted person in India to operate your account, you can grant them Power of Attorney (PoA). They can:

- Withdraw cash

- Pay utility bills

- Issue cheques

- Make investments (as permitted)

However, they cannot repatriate funds abroad.

Investment Options Linked to NRE Accounts

NRE accounts can be linked to investment channels like:

- Mutual funds (in INR)

- Equity markets via PIS (Portfolio Investment Scheme)

- NRE FDs for long-term capital growth

- Real estate purchases (subject to RBI norms)

Inoperative/Inactive NRE Accounts

If there are no customer-initiated transactions for over 2 years, the NRE account may become inactive or dormant. Reactivation requires submission of ID proof and updated KYC documents.

Common Issues Faced by NRE Account Holders

- Delays in remittance due to bank holidays

- High bank charges for wire/SWIFT transfers

- Currency conversion losses due to timing

- Complexity in documentation for account opening in some countries

Tips to Maximize NRE Account Benefits

- Maintain a mix of NRE and FCNR accounts for diversification

- Open NRE FDs with auto-renewal for seamless maturity

- Use international debit cards linked to NRE account for travel convenience

- Track forex rates to remit when conversion is favorable

Future Trends in NRE Banking

- Introduction of AI-driven banking assistants for NRIs

- Seamless mobile app-based remittances

- More competitive forex margins

- Simplified digital KYC and onboarding processes

Conclusion

An NRE account is a tax-free, fully repatriable, and convenient option for NRIs to manage their foreign earnings in India. Choose the right NRE, NRO, or FCNR account based on your financial needs.

- Best for: NRIs who earn abroad and want to save or invest in India.

- Apply online through major Indian banks for hassle-free processing.

Useful Links:

- Please click here for a detailed comparison of the above acounts that you can open and operate.

- Additionally, click here for a summary outlining banking considerations for NRIs that can help you get a full overview of what you need to be mindful throughout.

NRE Accounts FAQs

Answers to common questions about NRE accounts, usage, taxation, and repatriation rules.