Buying a property in India

As an NRI, one of the investment option being explored is investment in property in India. NRIs can buy property (both residential and commercial) and non-agricultural land in India.

We will look into the purchase process as well as the property documents you would need to acquire for the purchase of land as well as a flat.

Land Records

You may be interested in buying Land in India. Here are important document you need to be looking for before finalising the deal.

What are Land Records?

Land records are legal documents that prove the ownership of a person over a property or grant the right to a person to reside or stay on a property. Any person with the land records that prove he/she owns a property has the legal right to develop, demolish, rent, lease, mortgage or sell the property. They are also crucial to establishing and verifying property rights, resolving disputes, assessing land values, and supporting urban planning and infrastructure development initiatives.

Land records contain comprehensive information about the land, such as the owner’s name, property location, boundaries of the property, and historical transactions. These records are maintained by state or local government agencies operating under the Department of Revenue or Land Administration Departments.

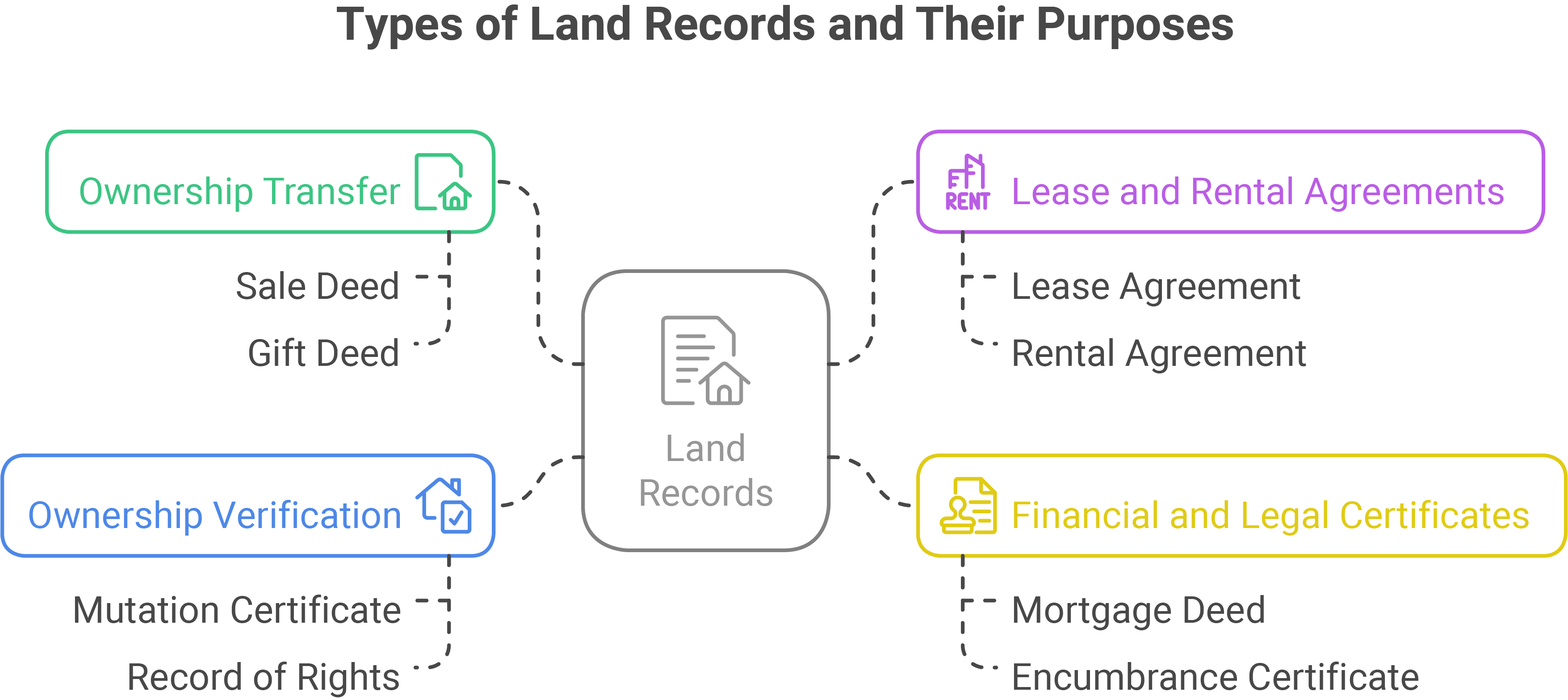

Different Types of Land Records in India:

- Sale deed: This document formally records the transfer of ownership from the seller to the buyer.

- Gift deed: This document that facilitates the transfer of property from one person (the donor) to another (the donee) without any monetary consideration. It’s a voluntary transfer of ownership, ensuring the gift is legally recognized.

- Lease agreement: a legally binding contract outlining the terms under which a tenant (lessee) can occupy and use a property owned by a landlord (lessor) for a specified period. It details the duration of the lease, rent amount, and the rights and responsibilities of both parties.

- Rental agreement: a legally binding contract between a landlord and a tenant outlining the terms and conditions of renting a property. It clarifies the rights and responsibilities of both parties, including rent, security deposit, term of the agreement

- Mortgage deed: a legal document that formalizes the agreement between a borrower and a lender, securing a loan against the borrower’s property. It outlines the terms of the loan, including the amount, interest rate, and repayment schedule, and grants the lender the right to foreclose on the property if the borrower defaults.

- Mutation certificate: This document legally records the transfer of ownership in the revenue records after a purchase, inheritance, or transfer.

- Encumbrance Certificate: This certificate verifies that there are no legal or financial encumbrances on the property, like outstanding loans or disputes.

- Survey and Land Records: Check for the presence of survey numbers and other land records.

- Property tax receipts: These are the document that verifies the payment of property tax to the local authorities. These receipts serve as proof that you have fulfilled your financial obligations related to property ownership. They detail the amount paid, the date of payment, and the period for which the tax was paid.

- Record of Rights: this is a legal document that details the ownership, usage, and liabilities associated with a piece of land. It serves as a comprehensive record of who owns the land, how it’s being used, and any pending dues or legal claims. Essentially, it’s a snapshot of the property’s current ownership, tenancy, and taxation details.

- Partition deed: a legal document that formally divides jointly owned property among its co-owners, establishing individual ownership of specific portions of the property. It ensures a clear division of property, clarifying each owner’s share and preventing future disputes.

- 7/12 Extracts (for state of Maharashtra): In Maharashtra, the 7/12 extract is a key document providing information about land ownership and other details, which can be found online.

Records establishing land ownership of legal heirs:

- Will or Probate certificate

- Succession certificate

- Legal heir certificate

Where to get Land Records?

In India, land records can be obtained from the following persons or entities:

Sellers

- The person selling the property, whether an individual seller, developer, or builder, will have the original property records with them. Sometimes, they might have submitted the land records to the bank for loan purposes. In such cases, you can visit the bank and request to view the land records to verify their correctness.

Register office

- The sub-register office where the land is registered will maintain the land records relating to that property. People can visit the sub-register office and apply for a certified copy of the land records.

Land record website

- States have their own land records websites, such as Bhoomi, Bhulekh, e-Rekha, etc., where anyone can visit and view the land records of a property. Certain land records can also be downloaded from these websites.

Why do we need of Land Records?

- People buying a property must look into the land records or title deeds to ensure that the sellers, developers, or builders have the legal right to sell it. Similarly, people in the real estate sector must maintain land records as they act as proof of ownership of the property.

- Even if an individual is not planning to sell his/her property, it is essential to keep the land records as they prove that he/she is the property owner and safeguard against the claim of ownership over the property by a third party, if any.

- Up-to-date land records help the owner to resolve property disputes or boundary conflicts. They provide a legal framework for establishing and verifying property rights and ensuring transparency in land transactions.

- Land records also enable property owners to mortgage, rent or lease their properties and earn money from it. Proper land records encourage investments in real estate by providing confidence among lenders, buyers and developers about the legality and security of property transactions.

- Land records facilitate accountability, transparency, and efficiency in land transactions. They are easy to obtain, especially after the digitisation and modernisation of land record management systems in India. Land records are significant for making informed decisions in the real estate sector and ensuring effective land governance.

Property records

You may be interested in purchasing an under construction flat in India. Here are important document you need to be looking for before finalising the deal.

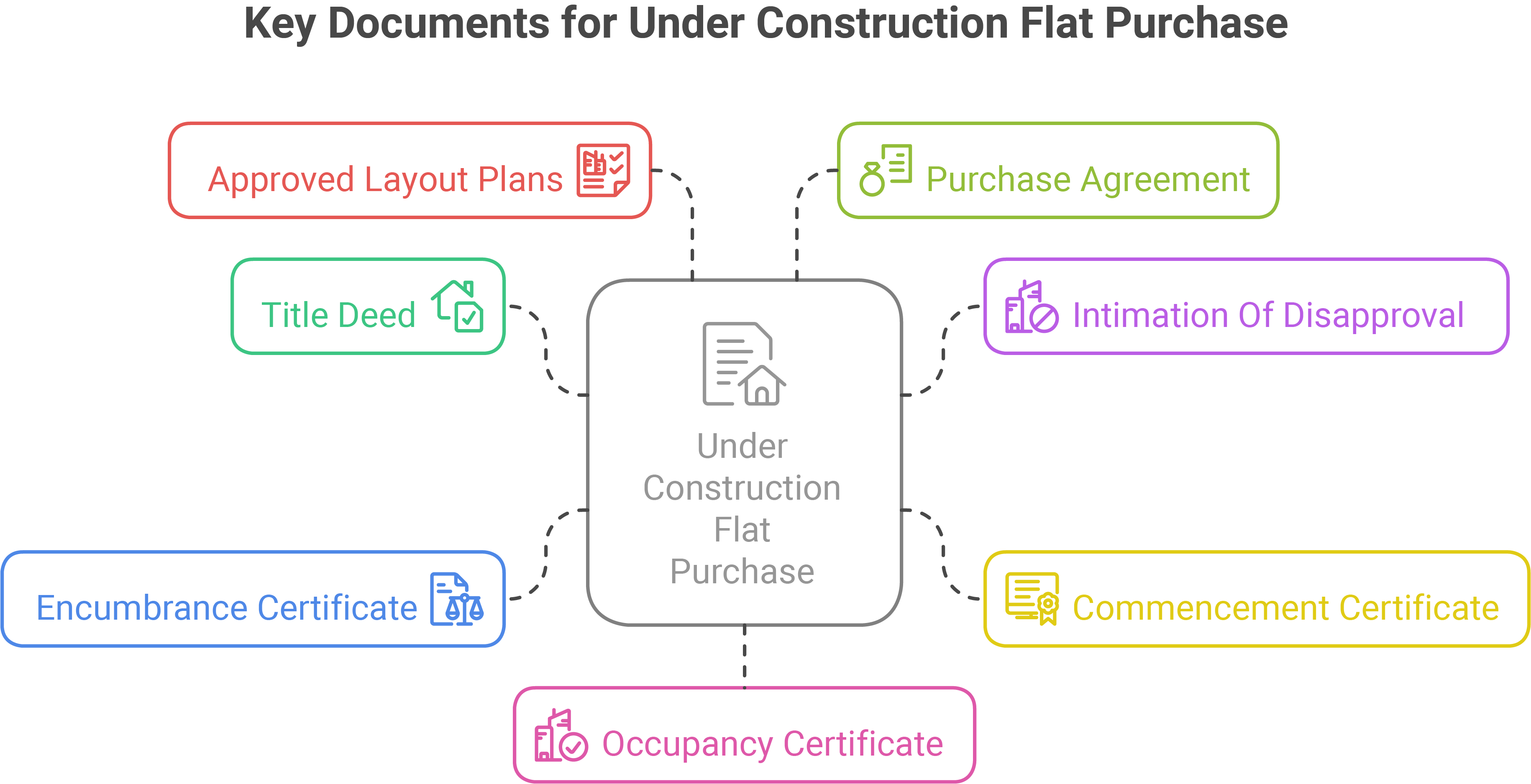

Typical documents required for purchasing an under construction flat include:

Title Deed

- This document will tell you whether the builder owns the property being sold and has the right to sell the property and the freedom to transfer ownership. Insist on seeing the original, and not a copy of the title deed. It will also tell you whether everything is legal or if there is litigation in progress regarding the property. A purchaser should check the original deed and confirm that the land is in the name of the developer, and that no one else has the right to sell it. It is advisable to get the title reviewed by a lawyer.

Intimation Of Disapproval (IOD)

- This is a set of permissions which must be obtained by a developer at various stages of construction. This would involve acquiring approvals and a No Objection Certificate (NOC) from various departments such as the Storm Water and Drain Department, Sewage Departments, Forest Department, Environment Department, Traffic and Coordination Department, Chief Fire Officer, Airport Authority and Pollution Board, among others. It is called a letter of disapproval because the letter is drafted only in the event of a disapproval. If the plans and construction project is approved, then the regulatory authority will simply issue a certificate of no-objection.

Commencement Certificate (CC)

- This is a document which must be issued by the local authorities and legally allows a builder to start the actual construction work. This is important as any construction without procuring a CC is illegal.

Encumbrance Certificate

- This can be obtained from the office of the registration authority (the sub registrar’s office) and tells you whether the property carries any legal or monetary liabilities or has any litigation pending. It can go as far back as 30 years.

Approved Layout Plans

- The layout plans must be approved by the appropriate planning authorities. Home purchasers need to exercise caution as there have been cases where developers deviated from the approved layouts, by adding extra floors or reducing open areas.

Purchase Agreement

- You should go through this document carefully to make sure it includes everything you were promised. You can only hold a builder or promoter legally accountable for what is in the purchase agreement, not what has been verbally promised to you. The agreement should contain all major details of the construction project such as the project specification, apartments, payment terms, completion deadlines and the type and amount of penalty, should any party default. The agreement should also contain a clause to transfer the common areas to the society. This ensures the plot remains with the original owners and that the developer cannot engage in further construction on this land.

Occupancy Certificate

- Issued by local authorities, this certificate states that the property has been constructed in compliance with the provided permissions. At this stage the developer would have completed all necessary water, sewage and electrical connections.

Purchase process

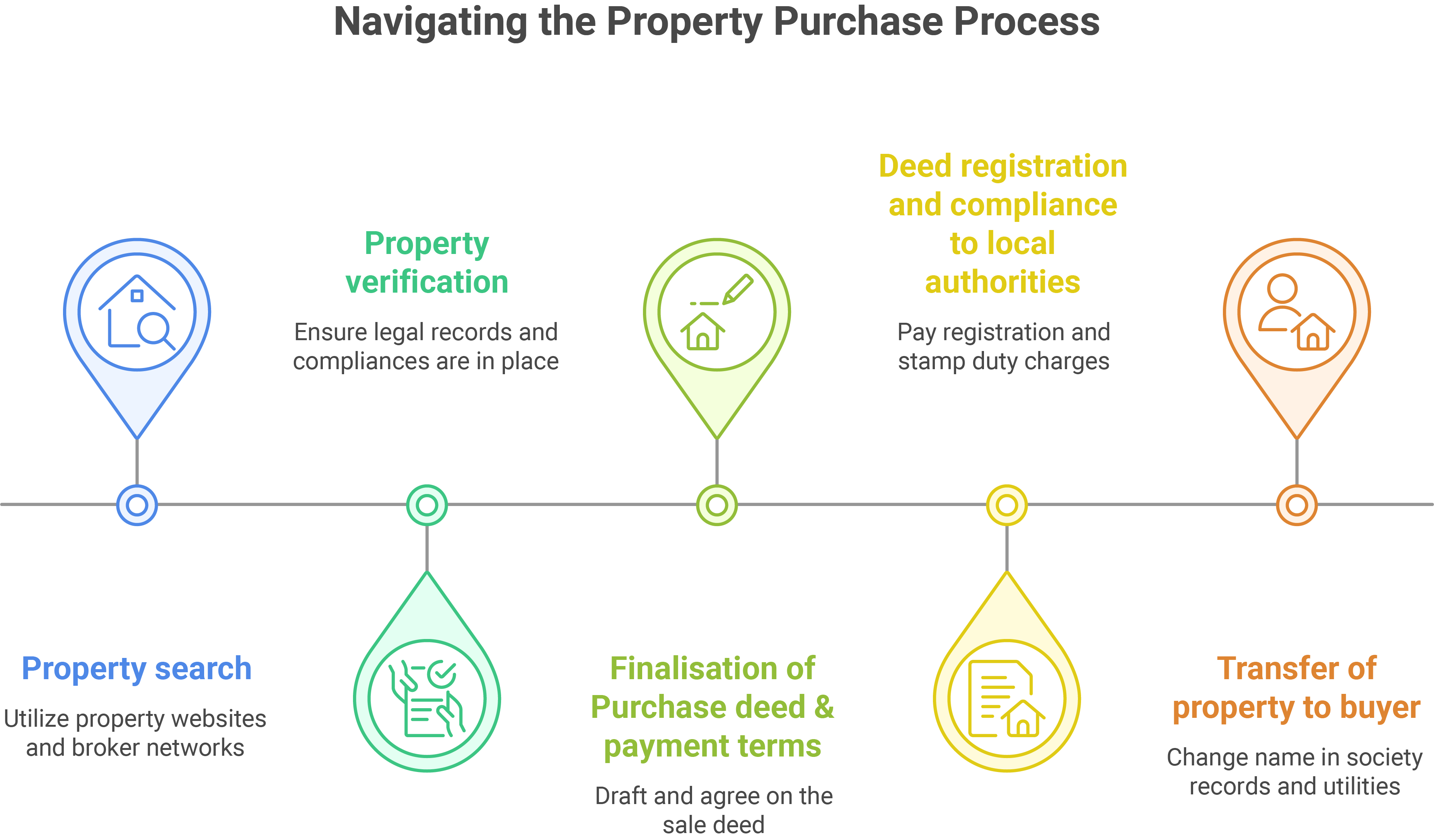

- Property search: You can use the property websites, local broker network to search the property you wish to purchase

- Property verification: You would need to ensure that all the legal records for property are in place. This involves extracting and verifying all the land / property records to ensure that that all compliances are met

- Finalisation of Purchase deed & payment terms: The Purchase deed between builder or previous owner needs to be drafted and agreed between the seller & buyer.

- Deed registration and compliance to local authorities: This involves payment of registration and stamp duty charges and registration of the Purchase deed with local authorities. If you would not be able to physically present for registration, you can give Power of Attorney (POA) to someone.

- Transfer of property to buyer: This involves change of name in society records (& share certificate), utilities and property tax with local authorities.

Some of the companies providing the above services are:

Regakwhiz: https://regalwhiz.com/

Nobroker: https://www.nobroker.in/

Inhering property in India

NRIs can inherit and manage ancestral property in India, with rights similar to resident Indians, subject to FEMA regulations. You can retain ownership, rent, sell, or gift the inherited property, and either be physically present during the registration of sale/gift deed or provide a power of attorney for property dealings.

Rights and Responsibilities of NRIs in Ancestral Property:

Inheritance Rights:

- NRIs have the same rights as resident Indians when inheriting property in India, including ancestral property.

- The time limit to claim ancestral property in India is typically around 12 years, but courts may consider valid reasons for delays.

Ownership and Management: They can own, manage, and transfer ancestral properties in India.

No Restrictions on Inheritance: There are no limitations on the types of property an NRI can inherit, including agricultural land and farmhouses, subject to FEMA regulations.

FEMA Compliance: All property transactions, including inheritance, must comply with the Foreign Exchange Management Act (FEMA).

Power of Attorney: NRIs can appoint a power of attorney (PoA) to manage the property on their behalf.

Partition of Property: NRIs can seek the partition of ancestral property through a civil suit in an Indian court, even if they are not physically present in India, with representation through a PoA.

Legal Assistance: Navigating Indian property laws can be complex, so seeking legal advice is recommended.

Managing ancestral Property as an NRI:

- Retain Ownership: You can retain ownership of the inherited property in your name.

- Rent Out: You can rent out the property and repatriate the rental income as per FEMA regulations.

- Sell the Property: You can sell the property, but sales are governed by FEMA rules.For selling the ancestral property, you need consent of all coparceners.

- Gift or Donate: You can gift or donate the inherited property, but be aware of the tax implications.