Mutual Funds Investment

Can NRIs Invest in Mutual Funds in India?

An NRI can invest in mutual funds in India as long as he/she adheres to the Foreign Exchange Management Act (FEMA).

- In terms of Regulation 2 of FEMA Notification No.13 dated May 3, 2000, Non-Resident Indian (NRI) means a person resident outside India who is a citizen of India.

- According to the Income-tax Act 1961, a resident is a person who has been in India for 120 days or more during a financial year or 365 days or more during the preceding 4 financial years and at least 60 days in that year. Therefore, NRIs include those individuals who visited India for less than 120 days in a financial year.

- This amendment was brought in the current financial year. Earlier, the 120-day threshold was 182 days. However, there is a catch here. If the total Indian income, that is, income accruing in India during the financial year, is more than Rs 15 lakh, only then the 120 days rule will apply. Visiting NRIs whose total taxable income in India is up to Rs 15 lakh during the financial year will continue to remain NRIs only if their stay does not exceed 181 days, as was the case earlier.

- The definition of NRI in FEMA decides where an NRI can invest, and the definition of an NRI in the Income Tax Act defines how these investments will be taxed.

How can NRI invest in Mutual Funds?

Set Up an Account:

Mutual fund Asset Management Companies in India cannot accept investments in foreign currency.

Indian laws, specifically the Foreign Exchange Management Act (FEMA), do not allow you to park your money in a regular resident savings account in India once you have achieved the NRI status. This law makes it compulsory for an NRI to have the knowledge and know the NRE and NRO account differences and know which suits you more.

- NRE: NRE Account is well suited for those who want to send the money they have earned overseas to India.

- NRO: Money kept in NRO accounts also has to be in Indian rupee and money cannot be repatriated to a foreign currency easily. NRO Accounts can be used by NRIs to deposit their earnings in India. This is an important difference between NRE and NRO accounts.

Once the account is activated, an NRI can invest by any of the below methods.

- Self or Direct:

- An NRI can carry out transactions, debiting or crediting through normal banking channels.

- Their application with the required KYC details must indicate that the investment is on a repatriable or non-repatriable basis.

- KYC documents consist of a recent photograph, certified copies of PAN card, a passport copy, residence proof of outside India, and a bank statement. The bank may require an in-person verification which an NRI can comply with, by visiting the Indian Embassy in their resident country.

- Through the Power of Attorney (PoA):

- Another common method is to have someone else invest on behalf of an NRI.

- In India, Mutual fund companies allow holders to invest on their behalf and take other decisions pertaining to their investments. However, the signatures of both the NRI investor and PoA should be present on the KYC documents to make such types of investment.

Get Your KYC done:

- An NRI must complete the KYC process before starting investment in Indian mutual funds.

- For that, they need to submit a copy of your passport (only relevant pages with name), date of birth, photo and address. The current residential proof, too, is a must, whether temporary or permanent resident in that country. Some fund houses may also insist on an in-person verification.

- Many mutual fund houses in India don’t allow NRIs from the USA and Canada to invest in their schemes because of the cumbersome compliance requirements under the Foreign Account Tax Compliance Act (FATCA). On the other hand, there are some fund houses that have certain conditions on which they allow investors based in the USA and Canada to put money in their schemes.So if you are an NRI from the USA or Canada, then look into the additional document requirement.

How to Redeem?

- For NRIs, mutual fund investments can be redeemed by following the redemption procedure mentioned by the fund houses. Different fund houses in India follow different procedures for redemption by NRIs.

- The AMC will credit the corpus (investment + gains) you get after fund redemption to your account after deducting taxes and shall be credited to the respective NRE or NRO bank account of the investor. They can also write a cheque for the same.

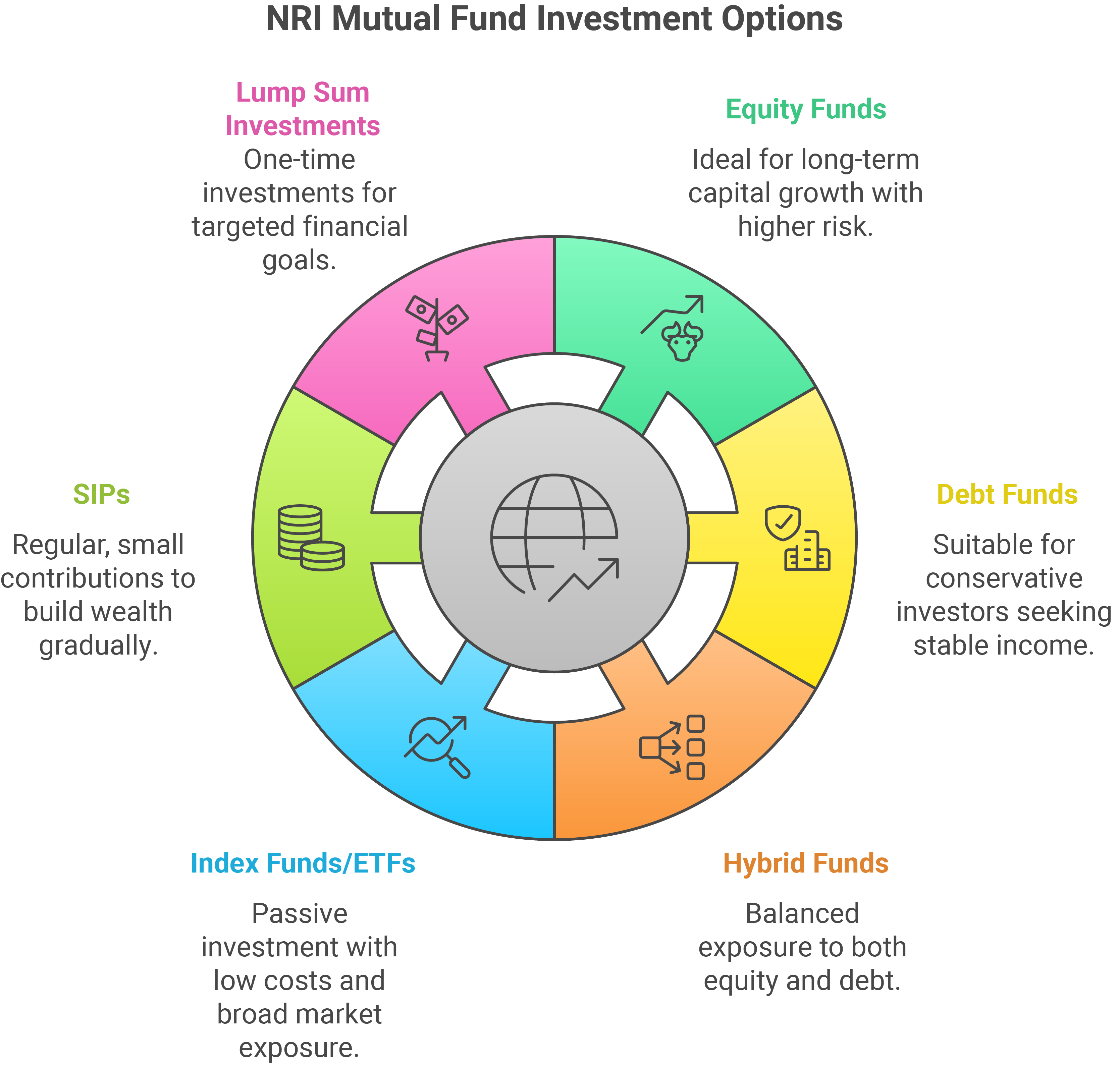

What is SIP (Systematic Investment Plan)?

SIP is one of the easiest and most convenient ways for NRIs to invest in mutual funds. It allows you to invest a fixed amount periodically (usually monthly or quarterly) into your chosen funds. The advantages of SIP include:

- Allows you to build wealth over time

- Reduces impact of market volatility

- Can adjust, pause, or increase your investments

Process to start an SIP, you must:

- Choose a mutual fund scheme.

- Decide on the SIP amount, date and frequency.

- Link your NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account for easy transactions.

- Complete KYC (Know Your Customer) formalities, which can be done online.

What is SWP (Systematic Withdrawal Plan)?

SWP allows you to withdraw a fixed amount periodically (usually monthly or quarterly) from your chosen funds. The advantages of SWP include:

- Provides steady income & tax efficiency

- Reduces impact of market volatility

- Can adjust, pause, or your cashflow

Process to start an SWP, you must:

- Choose your mutual fund scheme.

- Decide on the SWP amount, date and frequency.

- Link your NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account for easy transactions.

What About Taxation for NRIs?

Many NRI investors often fear that they will have to pay double tax when they invest in India, especially in mutual fund schemes. But certainly, that’s not the case if India has signed the Double Taxation Avoidance Treaty (DTAA) with the respective country.

These are the holding periods defined for different types of mutual funds:

| Type | Short-term holding | Long-term holding |

| Equity mutual funds | Less than 12 months | 12 months and more |

| Balanced mutual funds | Less than 12 months | 12 months and more |

| Debt mutual funds | Less than 36 months | 36 months and more |

The table below summarizes the tax on the capital gain from mutual funds:

| Type | Short-term capital gains (STCG) tax | Long-term capital gains (LTCG) tax |

| Equity-oriented mutual funds | 15% | 10% without Indexation |

| Balanced mutual funds | 15% | 10% without indexation |

| Debt-oriented mutual funds | As per tax slab | 20% without indexation |

Important Points to be noted for NRIs:

- If details of a foreign bank account are provided, the application of the NRI will be rejected.

- On redemption of mutual fund units, the tax will be deducted at the source of the capital gains made on the investment.

- Your investment into mutual fund schemes carries the right of repatriation of the amount invested and amount earned only until you remain an NRI.

- The compliance requirements in the USA and Canada are more stringent as compared to other nations. According to FATCA guidelines, all financial institutions must share the details of financial transactions involving a person from the USA working with the US Government.

- You must check if you are a resident of any of the 90 countries that have signed the Common Reporting Standard (CRS)? CRS is a global reporting system to combat tax evasion around the globe.

Types of Mutual Funds

- As an investor, you own units, which basically represent the portion of the fund that you hold, based on the amount invested by you. The increase in the value of the investments is then passed on to the investors/ unit holders in proportion to the number of units owned after deducting applicable expenses.

- Mutual funds have both advantages and disadvantages compared to direct investing in individual securities.

- The mutual fund industry is continuously emerging. Several industrial bodies are also investing in investor education. In fact, a basic inquiry about the types of mutual fund reveals that these are perhaps one of the most flexible, comprehensive and hassle-free modes of investments, that can accommodate various types of investment needs.

- Various types of mutual fund categories are designed to allow investors to choose a scheme based on the risk they are willing to take, the investable amount, their goals, the investment term, etc.

Schemes based on the Maturity Period

- Open Ended Scheme:

- This scheme allows investors to buy or sell units at any point in time. It does not have a fixed maturity date either. You deal directly with the Mutual Fund for your investment and redemption.

- The key feature is liquidity. You can conveniently buy or sell your units at net asset value (“NAV”) related prices. The majority of mutual funds, 59% approximately are open-end funds.

- Close Ended Scheme:

- This type of scheme has a stipulated maturity period and investors can invest only during the initial launch period known as the New Fund Offer (NFO).

- Once the offer closes, no new investments are permitted. The market price at the stock exchange could vary from the scheme’s Net Asset Value (NAV), because of the demand and supply situation, unit holder’s expectations and other market factors.

- Some close ended schemes will give you an additional option of selling your units directly to the mutual funds through periodic repurchase at NAV related prices.

- SEBI Regulations ensure that at least one of the two exit routes are provided to the investor.

- Interval:

- It operates as a combination of open and closed ended scheme, it allows investors to trade units at predefined intervals. They may be traded on the stock exchange or they may even be open for sale or redemption during pre-determined intervals at NAV related prices.

- When it comes to selecting a scheme to invest in, one should look for customized advice. Choose the scheme that provides the right combination of growth, stability and income, keeping your risk appetite in mind.

Schemes based on Principal Investments:

One of the most important points in the circular is that different types of mutual fund schemes should be clearly distinct in terms of investment strategy and asset allocation. The schemes will be broadly classified into following categories

-

Equity Schemes:

SEBI has decided total 11 categories under Equity Schemes but a mutual fund company can only have 10 categories and it has to choose between Value or Contra. Still 10 categories looks bit high but I think its fair considering the possible variations in the strategy.To make this easier SEBI has also defined meaning of Large Cap, Mid Cap and Small Cap as.

- Large Cap: Top 100 companies in terms of market capitalization

- Mid Cap: 101st- 250th companies in term of market capitalization

- Small Cap: 251st company onwards in terms of market capitalization

| Multi Cap Funds | Minimum investment in equity & equity related instruments–65% of total assets | Multi Cap Fund – An equity mutual fund investing across Large Cap, Mid Cap, Small Cap stocks |

| Large Cap Funds | Minimum investment in equity & equity related instruments of large cap companies – 80% of total assets | Large Cap Fund – An equity mutual fund predominantly investing in Large Cap stocks |

| Large and Mid Cap Funds | Minimum investment in equity & equity related instruments of mid cap stocks – 35% of total assets | Large & Mid Cap Fund – An open ended equity mutual fund investing in both large cap and mid cap stocks |

| Mid Cap Funds | Minimum investment in equity & equity related instruments of mid cap companies – 65% of total assets | Mid Cap Fund – An equity mutual fund predominantly investing in Mid Cap stocks |

| Small Cap Funds | Minimum investment in equity & equity related instruments of small cap companies – 65% of total assets | Small Cap Fund – An equity mutual fund predominantly investing in Small Cap stocks |

| Dividend Yield Funds | Scheme should predominantly invest in dividend yielding stocks. Minimum investment in equity – 65% of total assets | An equity mutual fund predominantly investing in dividend yielding stocks |

| Value Funds | Scheme should follow a value investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An equity mutual fund following a value investment strategy |

| Contra Funds | Scheme should follow a contrarian investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An equity mutual fund following contrarian investment strategy |

| Focused Funds | A scheme focused on the number of stocks (maximum 30) Minimum investment in equity & equity related instruments – 65% of total assets | An equity scheme investing in maximum 30 stocks (mention where the scheme intends to focus, viz., multi cap, large cap, mid cap, small cap) |

| Sectoral Funds or Thematic | Minimum investment in equity & equity related instruments of a particular sector/particular theme – 80% of total assets | An open ended equity scheme following the theme as mentioned |

| ELSS Funds | Minimum investment in equity & equity related instruments – 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance) | An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

Mutual Funds will be permitted to offer either Value fund or Contra fund.

-

Debt Schemes:

SEBI has decided total 16 categories under Debt Schemes. 16 categories are very high for debt funds considering their similarity in risk and returns from a retail investor perspective.Some categories like Overnight Fund and Liquid Fund are similar. Same is the case with money market fund and ultra-short term debt fund categories.

| Overnight Funds | in overnight securities having maturity of 1 day | A debt scheme investing in overnight securities |

| Liquid Funds | Investment in Debt and money market securities with maturity of upto 91 days | A liquid scheme |

| Ultra Short Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months – 6 months | An ultra – short term debt scheme investing in instruments with Macaulay duration between 3 months and 6 months |

| Low Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months – 12 months | A low duration debt scheme investing in instruments with Macaulay duration between 6 months and 12 months |

| Money Market Funds | Investment in Money Market instruments having maturity up to 1 year | A debt scheme investing in money market instruments |

| Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year – 3 years | A short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years |

| Medium Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years | A medium term debt scheme investing in instruments with Macaulay duration between 3 years and 4 years |

| Medium to Long Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 4 – 7 years | A medium term debt scheme investing in instruments with Macaulay duration between 4 years and 7 years |

| Long Duration Fund | Investment in Debt & Money Market Instruments such that the Macaulay duration of the portfolio is greater than 7 years | A debt scheme investing in instruments with Macaulay duration greater than 7 years |

| Dynamic Bond Funds | Investment across duration | A dynamic debt scheme investing across duration |

| Corporate Bond Funds | Minimum investment in corporate bonds – 80% of total assets (only in highest rated instruments) | A debt scheme predominantly investing in highest rated corporate bonds |

| Credit Risk Funds | Minimum investment in corporate bonds – 65% of total assets ( investment in below highest rated instruments) | A debt scheme investing in below highest rated corporate bonds |

| Banking and PSU Fund | Minimum investment in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions – 80% of total assets | A debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions |

| Gilt Fund | investment in Gsecs – 80% of total assets (across maturity) | A debt scheme investing in government securities across maturity |

| Gilt Fund with 10 year constant duration | Minimum investment in Gsecs – 80% of total assets such that the Macaulay duration of the portfolio is equal to 10 years | A debt scheme investing in government securities having a constant maturity of 10 years |

| Floater Fund | Minimum investment in floating rate instruments – 65% of total assets | A debt scheme predominantly investing in floating rate instruments |

-

Hybrid Schemes:

SEBI has decided total 7 categories under Hybrid Schemes but a mutual fund company can only have 6 categories and they have to choose between Balanced Hybrid Fund or Aggressive Hybrid Fund. Also, Finally SEBI has made Arbitrage Fund under Hybrid Fund category.

| Conservative Hybrid Funds | Investment in equity & equity related instruments – between 10% and 25% of total assets; Investment in Debt instruments – between 75% and 90% of total assets | A hybrid mutual fund investing predominantly in debt instruments |

| Balanced Hybrid Funds | Equity & Equity related instruments – between 40% and 60% of total assets; Debt instruments – between 40% and 60% of total assets. | No Arbitrage would be permitted in this scheme 50-50 balanced scheme investing in equity and debt instruments |

| Aggressive Hybrid Funds | Equity & Equity related instruments – between 65% and 80% of total assets; Debt instruments – between 20% – 35% of total assets. Most of the balanced funds will fall into this category. | A hybrid scheme investing predominantly in equity and equity related instruments |

| Dynamic Asset Allocation Funds or Balanced Advantage | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes. Foreign investment will be considered as a separate asset class. | A hybrid mutual fund which will change its equity exposure based on market conditions |

| Multi-Asset Allocation Funds | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes. Foreign investment will be considered as a separate asset class. | A scheme investing in 3 different asset classes. |

| Arbitrage Funds | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments – 65% of total assets | A scheme investing in arbitrage opportunities |

| Equity Savings | Minimum investment in equity & equity related instruments – 65% of total assets and minimum investment in debt – 10% of total assets. Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document | A scheme investing in equity, arbitrage, and debt |

-

Solution Oriented Schemes:

Retirement Fund Scheme having a lock – in for at least 5 years or till retirement age whichever is earlier A retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier) Children’s Fund Scheme having a lock – in for at least 5 years or till the child attains age of majority whichever is earlier A fund for investment for children having a lock – in for at least 5 years or till the child attains age of majority (whichever is earlier)

-

Other Schemes:

Index Funds/ ETFs Minimum investment in securities of a particular index (which is being replicated/ tracked) – 95% of total assets A mutual fund replicating/ tracking any index FoF’s (Overseas/Domestic) Minimum investment in the underlying fund – 95% of total assets A fund of fund is a mutual fund that invests in other mutual funds

Other Schemes

Top 10 Mutual Fund Houses in India:

- SBI Mutual Fund

- ICICI Prudential Mutual Fund

- HDFC Mutual Fund

- Aditya Birla Sun Life Mutual Fund

- Kotak Mahindra Mutual Fund

- Nippon India Mutual Fund

- Axis Mutual Fund

- UTI Mutual Fund

- IDFC Mutual Fund

- DSP Mutual Fund

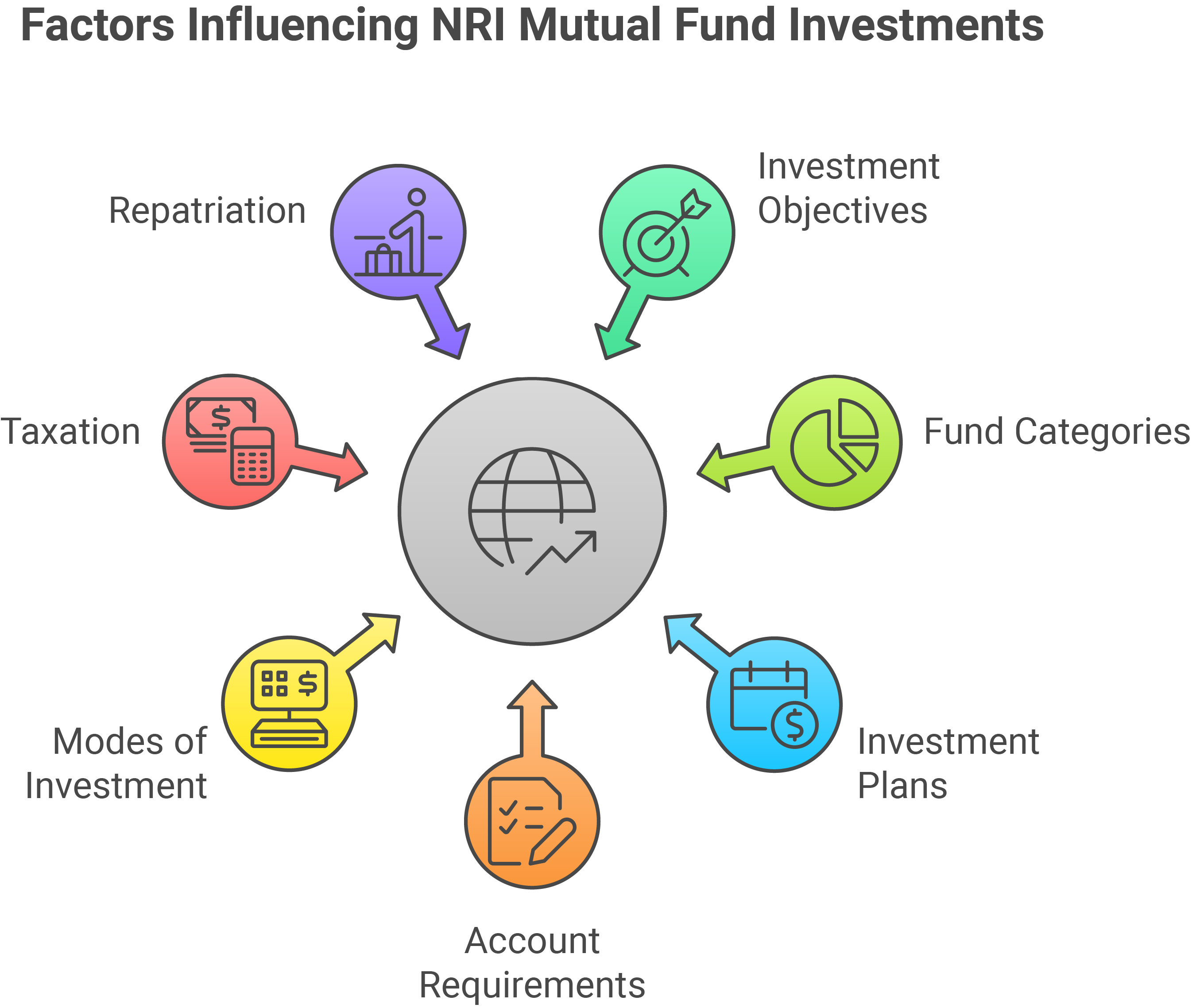

Factors to consider before choosing a Mutual Fund House

Mutual funds are among India’s most popular investment options due to their flexibility, affordability, and diversification benefits. However, choosing the right one can be overwhelming with many mutual fund houses in India. Therefore, before making an investment decision, it is crucial to consider various factors impacting the mutual fund’s performance.

Some of the critical factors to consider before choosing a mutual fund house in India are-

Performance History:

It is essential to look into the track record of the mutual fund house and the performance of its schemes in the past. This will give you an idea of the house’s ability to deliver consistent returns over time.

Asset Size:

A larger asset size can indicate stability, reliability, and consistency in returns. However, it is essential to also consider the fund’s performance relative to its size.

Fund Management:

A mutual fund house’s success depends mainly on the expertise of its fund managers. Therefore, it is essential to research the fund manager’s experience and investment philosophy to determine if it aligns with your investment objectives.

Expense Ratios:

It is essential to consider the costs associated with investing in a mutual fund, including expense ratios and management fees. High expense ratio can eat into your returns over time, so choosing a low-cost mutual fund is crucial.

Investment Style:

Some mutual fund houses specialize in specific investment styles, such as growth or value investing. Therefore, it is essential to align your investment style with the mutual fund house you choose.

Market Reputation:

The market reputation of the mutual fund house can be a good indicator of its overall quality. Consider looking into the company’s history and its rating by industry experts.

Investor Services:

It is essential to consider the level of customer service and support the mutual fund house provides. You should be able to access investment information and receive assistance when needed.

Investment Options:

Consider the range of investment options the mutual fund house offers, including equity, debt, balanced and international funds. You should also consider the minimum investment amount required in a Mutual Fund.